In 2019, a deadly virus established its roots in Wuhan,

China and spread out in the world at an unimaginable rate which took the world

by surprise. The pandemic which originated from the small town of Wuhan now

threatens the lives of people in almost 185 countries worldwide. It’s spread

cause a dooming effect on the global economy as worldwide business shutdowns caused

millions of people to lose their jobs. World major economies are expecting the worst crisis than the Great depression.

IMF REPORT:

Recently IMF published its WORLD ECONOMIC OUTLOOK(WEO) in

which Global Growth is projected at -4.9 per cent showing a 1.9 percentage

points drop as compared to April 2020 WEO forecast. It will wipe out $12 trillion over the span

for two years.

COVID-19 has proven to be worse than predicted for the first

half of 2020 in terms of economic activities and its recovery would be more

gradual as compared to previous estimates. IMF estimated global growth of

5.4% for 2021 which is 6.5% lower than in the pre-pandemic projections.

This will severely affect low-income household and cause millions

of people to go beneath the poverty line and will imperil the progress made in

reducing extreme poverty since the 1990s worldwide.

IMF reported that these projections have a great number of

uncertainty as it depends on the situation of Pandemic worldwide as they are

predicting a slower spread of COVID-19 in latter 2020 if Social distancing is

maintained strictly.

STOCK MARKET:

Stock Market has been destabilized after COVID-19 spread out

in the world causing a drop in shares of many Large companies which will affect the

value of pensions or individual savings accounts(ISAs). Major market holders

saw a huge drop in stocks after 31 December 2019.

Taking the example of three large companies Dow Jones, FTSE,

Nikkei: these companies saw the worst quarterly drops in the first three months of the year

for 3 decades.

Investors are in confusion as they are not clear about what will happen next and they think that government actions are not enough to stop the economic decline.

Many countries such as Pakistan, UK recently slashed interest

rate to encourage investors and borrowers so it will support the economy up to some

extent.

OIL INDUSTRY:

The world has seen a severe drop in Oil demand after it went

into Lockdown. The Oil markets which was previously affected by the rift between

OPEC and Russia weren’t able to sustain the attack of COVID-19. It caused OIL

prices to drop worst in 21-year.

For the first time in history, US barrel Prices went Negative even after OPEC decided to cut production but there are still more reserves of crude oil than that which the world requires.

UNEMPLOYMENT:

For the Fiscal year 2020, it is estimated that if Lockdown is

extended in Pakistan up to 10 million people will lose their jobs especially

daily wagers will be effected. This will also cause a negative GDP growth for the year 2020 as indicated by the reports of International Financial Institutions.

In the US alone, a record number of people filed for unemployment in the last six weeks to get benefits from government support which hints it as an end

of a decade long economic expansion of the US.

In the United Kingdom, approximately 1 million people filed for

benefits in just two weeks.

These huge numbers are due to government restriction on

business environment to stop the spread of COVID-19.

Technology in Full Bloom:

The COVID-19 pandemic has proven a blessing in disguise for

the tech companies worldwide, as due to lockdown governments all over the world

are advising people to work from up to the extent possible.

Most educational institutions have adopted online platforms

to continue their academic year. A platform such as ZOOM and Microsoft Teams have

seen a huge rise in their users which increased their share values in stock

market.

Amazon’s share price has seen new heights due to the high

demand for online shopping. Online streaming platforms such as Netflix also got

their share of fortune as at one point it was more valuable in stocks as compared

to ExxonMobil.

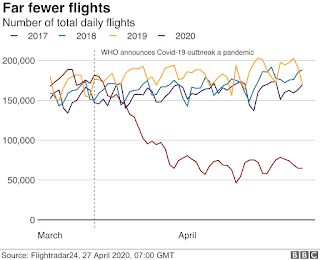

Travel & Tourism:

Travel & Tourism are one of the worst affected sectors due to worldwide Lockdown during Pandemic. All tourist spots have closed their doors for visitors, major transport giants are on vacation due to lockdown, Flight operations of all airlines are restricted. People cancelling business trips and holidays.

Travel & Tourism are one of the worst affected sectors due to worldwide Lockdown during Pandemic. All tourist spots have closed their doors for visitors, major transport giants are on vacation due to lockdown, Flight operations of all airlines are restricted. People cancelling business trips and holidays.

According to Mobility Market Outlook on Covid-19, The global

revenue of Travel & Tourism is expected to be 34.7 per cent lower as

compared to the previous fiscal year. $447.7

billion U.S dollars in 2020 dropping from 712 billion U.S dollars in the previous

forecast.

All these figures reflect a serious loss of business with

negative growth because of travel restrictions implemented by more than 100

countries. EU banned travellers from outside of bloc in the march to control

movement across its borders. On the other Trump-led US administration has

banned travellers from Europe.

The data from flight radar shows that the number of flights have

seriously dropped since pandemic spread.

0 Comments